REGISTER NOW FOR THE NCAC – USAEE ANNUAL CONFERENCE - WEDNESDAY, APRIL 24, 2019

The topic for the all-day conference is The Global Quest for Energy Security. The keynote speaker is David Petraeus, Chairman of KKR Global Institute.

General Petraeus is former director of the Central Intelligence Agency and was commanding general of the International Security Assistance Force in Afghanistan, as well as Commander of United States Central Command.

The conference will be held at George Washington University in the Marvin Center Continental Ballroom. A full agenda is posted on the NCAC website. Please register now to reserve your space; we expect the event will sell out.

NCAC ANNUAL DINNER FEBRUARY 5, CO-HOSTED BY THE EMBASSY OF CANADA, WITH SPECIAL GUEST ED MORSE

More than seventy people attended the NCAC Annual Dinner on February 5 to hear Ed Morse, global head of commodities research at Citi, speak about Oil and the Heisenberg Principle: How OPEC+ efforts to assure market stability become a source of market volatility.

Morse served as the Deputy Assistant Secretary of State for Energy Policy in both the Carter and Reagan Administrations; in management at Phillips Petroleum Co.; as co-founder of PFC Energy; and as publisher of Petroleum Intelligence Weekly. He has helped design Yemen's oil pricing policy and assisted in the negotiations of its initial export contracts. He also helped the UN Security Council design the Oil-for-Food Program for Iraq and assisted in negotiations with Baghdad to achieve its agreement. He is a Senior Fellow of both the USAEE and the IEEJ and in 2018 was named by Petroleum Economist in its inaugural “Global Energy Elite” issue as among the ten most prominent individuals in energy banking and finance. Morse’s presentation is available on the NCAC website.

NCAC Is grateful to NCAC Council member Aaron Annable, Counsellor for Energy and the Environment at the Embassy of Canada, for facilitating Canada’s role as co-host.

Click here for the 2019 Photo Library to view more photos from the dinner

ALAN LEVINE HONORED WITH 2019 MARK LIVELY AWARD AT ANNUAL DINNER

By Elaine Levin, Immediate Past President of NCAC and President of Powerhouse, an energy price risk management company

At the NCAC Annual dinner at the Canadian Embassy on February 5, NCAC Immediate Past President Elaine Levin presented the 2019 Mark Lively award for dedicated support and service to Alan Levine. Elaine remarked:

At the NCAC Annual dinner at the Canadian Embassy on February 5, NCAC Immediate Past President Elaine Levin presented the 2019 Mark Lively award for dedicated support and service to Alan Levine. Elaine remarked:

Al is one of NCAC’s founding members. He became the second NCAC president in 1980. His area of expertise is energy futures markets and hedging price risk. He was a consultant to the New York Mercantile Exchange when they formed the first successful energy futures contract, the home heating oil contract that is still traded today.

Al shares his knowledge generously. He has made presentations to NCAC many times over the years, demystifying a part of energy economics and finance that is very important to energy pricing domestically and increasingly internationally. He presented a four-hour workshop on hedging, futures and options at the September 2018 USAEE conference in DC.

When NCAC was founded in 1978, it was designed as a forum where energy professionals could share ideas and discuss important energy issues. One of the express missions of the association was to promote interest in energy economics among college students and young professionals. That support continues today through the NCAC mentor program.

Al embraced this idea throughout his career. In 1982, he became an energy futures broker, helping companies hedge price risk. In 1988, he started a search for an intern. NCAC was offering a scholarship to students interested energy economics. Al volunteered to contact all the local colleges and universities, letting them know about the offer.

Luckily for me, only my university, Marymount, responded to that outreach. So, of course, that is where he went to find his intern. Al and I have worked together ever since. Everyone should be so fortunate to have had such supportive and caring mentor. I’d like to think we are NCAC’s longest running mentoring match!

In 2012, Al, David Thompson and I left Morgan Stanley to start our own risk management company, Powerhouse. Even now, when we interview a candidate for a position or internship, Al’s introduction is always the same, ‘We are in the best industry in the world. I have been in energy most of my career, and what a ride!’ I am happy to present this award to a terrific mentor, my business partner and good friend, Alan Levine.

NCAC TOUR OF WASHINGTON GAS PIPETOWN TRAINING FACILITY

By Joel S. Yudken, Ph.D., Principal, High Road Strategies, and NCAC Treasurer

Every year, NCAC hosts at least one interesting field trip to sites of important regional energy-related activities. This year, on Thursday, February 21, fourteen of us took a half-day tour of the Washington Gas operations center in Springfield, Virginia.

About eight of us met in downtown DC to take a bus, and the rest drove directly to the center. Washington Gas serves over 1 million customers in the Metro area, supplying natural gas and other energy services to much of Northern Virginia, all of Washington, DC and parts of surrounding Maryland counties.

After a brief orientation, our hosts showed us around the Pipetown facility. It’s a state-of the-art training center, opened in 2009, built to simulate an urban community, with the purpose of providing a realistic training environment for field operators, line supervisors and emergency responders. The trainers can create a wide array of realistic scenarios, including a damaged facility, leak or fire emergency scenarios.

Aside from Washington Gas employees, the facility trains approximately 400 firefighters from local jurisdictions each year. Our group was also briefed on the center’s dispatch operations, which can be called on to respond to as many as 400 incidents each day, such as broken pipes and residential leak reports. We visited the gas control office, where large computer screens track pipeline flows and alerts, including connections to citygates of local distributors across 14,000 miles of pipeline.

Finally, we learned about the company’s Accelerator Replacement Program (ARP) created to replace aging cast iron, steel, and pre-1975 plastic pipelines throughout the system. After the tour, those of us on the bus stopped at a restaurant in Alexandria for lunch to get to know each other better and network, always one of the most enjoyable benefits of these trips.

VENEZUELA’S OIL DECLINE AND AMERICAN ENERGY INDEPENDENCE

By Peter E. Paraschos, Director, Energy and Geopolitical Risk, International Technology and Trade Associates, Inc.

Venezuela is a petrostate in abject decline, its society mired in sustained politico-economic crisis, and its once robust oil industry dogged by declining output and U.S. sanctions.

U.S. policy toward Venezuela now openly aims to replace the Maduro regime. On January 23, the Trump Administration recognized Juan Guaido, head of Venezuela’s National Assembly, as the country’s new interim president. On January 28, the administration blocked U.S. companies from conducting financial transactions with state-owned PdVSA, effectively curbing U.S. imports of Venezuelan heavy crude oil.

Incomplete Energy Information Administration data indicates that Venezuela exported about 500,000 barrels of heavy crude oil per day (b/d) to U.S. Gulf Coast refineries in 2018. According to recent reports, U.S. imports of Venezuelan crude declined to a 28-year low of 385,000 b/d in November 2018.

While the recent surge of U.S. and international pressure has yet to produce the desired political result in Caracas, the absence of Venezuelan heavy crude has created a shortage in the U.S. market. Reduced supply is pushing up heavy crude prices, cutting refiner margins on diesel and other middle distillate fuels, and jeopardizing the price competitiveness of U.S. middle distillate exports.

U.S. refinery companies, which process about half the world’s supply of heavy crude, are now seeking alternative supplies. However, this is proving difficult. Canada is cutting production of heavy crude in Alberta due to export pipeline constraints, and Saudi Arabia is cutting exports of heavy crude to support the OPEC+ production restraint agreement of December 2018. This leaves U.S. and Asian refiners competing for scarce heavy crude supplies from relatively smaller suppliers.

Record increases in U.S. oil output are predominantly light in quality and cannot replace heavy crude required by the highly complex U.S. refineries along the Gulf Coast and in the midcontinent region. And the U.S. shale revolution is of no help. Even as the United States races toward net petroleum exporter status, its world class refinery sector will remain dependent on imported heavy crude over the long-term.

THIS GREEN HOUSE

By Ben Schlesinger | Benjamin Schlesinger and Associates, LLC (BSA)

Tesla Batteries, late winter solar energy, and more…

Tesla Batteries, late winter solar energy, and more…

Our attempted-carbon-neutral home in St. Michaels, Maryland, is now finished, and we’ve moved into this most beautiful house! Energy bills are incredibly low – just paid our January bill to Choptank Electric Cooperative, totaling $22. And that’s the highest monthly electric bill since July, when the solar PV panels went live. Awesomely low compared to other houses this size in the mid-Atlantic region; we just paid $660 for gas and electricity in a comparably-sized, and well-insulated Bethesda house. As we’ve pointed out before, this amazing savings is owed to highly-insulated walls, 8 geothermal wells, and 50 SunPower PV panels.

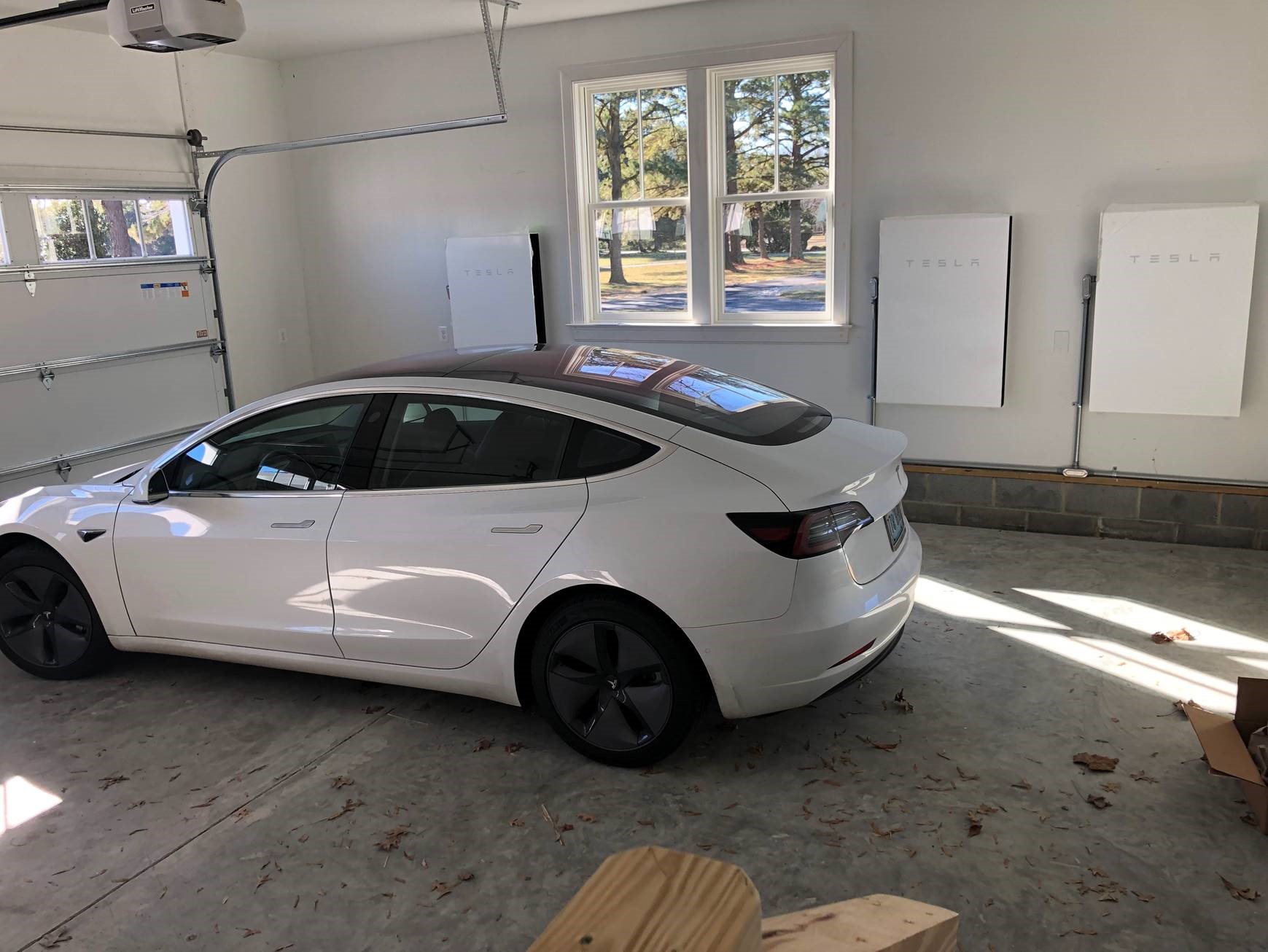

On January 9, Tesla delivered our 3 PowerWall batteries, Manny, Moe and Jack, and installed them on the garage wall. See the photo of Manny, Moe and Jack….and Joyce’s Model 3 Tesla. Given the severe winter weather that’s ensued, we’ve kept the batteries topped off, relying on them mainly for emergency back-up. Sure enough, they powered the house seamlessly during one brief outage in February.

Our batteries charge preferentially on solar power, so it’s green storage, but it’s also a green challenge. The question is how best to use them to maximize carbon avoidance. We’ll start next month by experimenting with different modes to time-shift loads. Initially, we’ll use them to abate the steep evening ramp-ups in energy demand that follow sunny days, much as major Li-Ion battery installations are used in Southern California.

The idea is that PJM uses its most polluting generators to meet this need, so we target the batteries to avoid that. Another pattern will be to use them to meet our mid-evening demand using stored solar power. Yet another will be to preferentially charge the EVs with solar power. Only with a more complete understanding of PJM’s marginal fuel at each 15-minute interval will we be able to maximize the effectiveness of our batteries in avoiding carbon emissions.

Meanwhile, the “power plant on the roof,” combined with a low-energy-demand house, is amazing. As the days grew longer, we’ve found that by late February we’re now steadily putting more energy into the grid than withdrawing on sunny days. Snow cover has been less of a problem than we thought – despite the panels’ nearly zero-degree angle (flat) mounting, it’s been taking only a day for the snow to melt away and for solar energy production to be restored.

NEW ENGLAND ELECTRICITY RATES: QUITE A DIFFERENCE

By Jim McDonnell and Evelyn Teel, Avalon Energy Services, LLC

Compared to the rest of the United States, electricity prices in New England are high. Nothing surprising there. So, just how expensive are they? Well, it depends. And, the surprising part is which utility, in one comparison, has the lowest rates.

First, some background.

Eversource Energy is an investor-owned utility headquartered in Hartford, CT and Boston, MA. Eversource is the rebranded name of Northeast Utilities, after its merger with NSTAR in 2012. Through its three electric distribution companies, Eversource operates New England’s largest energy delivery system and has 3.2 million electricity customers.

United Illuminating Company, a subsidiary of Avangrid, Inc., is an electric distribution company serving 325,000 customers in Connecticut. Avangrid, through its four electric utility subsidiaries, serves about 2.2 million customers in New England and New York State.

Wallingford, Connecticut is a town of 45,000 people located between Hartford and New Haven. Despite its size, the town operates its own municipal electric utility, known as the Wallingford Electric Division (WED).

Despite operating in the same geographic area, the three utilities vary dramatically in terms of their rates and the costs to their consumers.

A recent bill insert sent out by WED provided the following rate comparison. These are residential rates for an account that averages 750 kWh per month.

Utilities have different energy procurement strategies and different infrastructure issues, which contribute to their varied pricing. Furthermore, municipal electric utilities are exempt from certain mandates that affect the pricing of larger utilities. However, the 6.2 and 11.5 cents per kWh differences between a small municipal utility and the two large investor-owned utilities are dramatic.

Note: The WED bill insert was provided by Dan McDonnell of Wallingford, CT.

The Avalon Advantage – Visit our website at www.avalonenergy.us, call us at 888-484-8096, or email us at info@avalonenergy.us.