|

NCAC USAEE Newsletter – May 2019

June 21 NCAC Luncheon - The Energy Workforce in Transition

The June 21 NCAC luncheon, “The Energy Workforce in Transition” will feature Joel Yudken, economist and technology policy analyst. Yudken is principal and founder of High Road Strategies LLC. His research is focused on manufacturing, energy and workforce issues. His clients have included not-for-profit policy and environmental organizations, business associations, labor organizations, universities, and think tanks. His most recent publication is A Federal Policy Agenda for Revitalizing America’s Manufacturing Communities.

NCAC President Travels to Greece for Energy Economics Conference

By Michael Ratner

In early May, I got to travel to Athens, Greece to participate in the Hellenic Association for Energy Economics’ (HAEE) conference, Energy Transition: SE Europe and Beyond. I was invited to participate by Kostas Andriosopoulos, Chairman of HAEE, and Vice President for Publications for IAEE. During my time there I learned a lot and met many smart people, including Christophe Bonnery, President of the IAEE.

The three-day conference covered many topics: geopolitics of the energy transition, LNG bunkering, challenges and innovations of a green energy transition, and energy privatization, among other issues. I participated in a panel discussion on the Geopolitics of Energy and Energy Security for Europe. This is a topic I have written on in my capacity at Congressional Research Service and discussed in meetings and conferences here in Washington. The opportunity to exchange ideas and views with Europeans on this topic was fantastic. I encourage everyone in our membership to attend an IAEE or USAEE event if possible. Going to these events really shows the breadth and depth of the greater international association.

Michael Ratner is an energy policy specialist in the Congressional Research Service. He is the president of NCAC.

Two Guest Speakers Available for Travel to USAEE Chapters

By Natalie Kempkey

If you belong to a chapter of the US Association of Energy Economists (USAEE) you should know about the opportunity to have one of the USAEE Distinguished Lecturers come speak at an event for your chapter.

This year, the two Distinguished Lecturers are Guy F. Caruso and Russell Gold. If your chapter is interested in hosting a presentation by either of these speakers, please contact USAEE VP of Membership and Chapter Liaison Natalie Kempkey.

Guy F. Caruso is a senior adviser in the Energy and National Security Program at CSIS and was the 2018 USAEE President. Prior to joining CSIS, he served as administrator of the U.S. Energy Information Administration (EIA) from July 2002 to September 2008. EIA is the statistical agency within the U.S. Department of Energy (DOE) that provides independent data, forecasts, and analyses regarding energy. Before leading EIA, Caruso had acquired over 40 years of energy experience, with particular emphasis on topics relating to energy markets, policy, and security. He first joined DOE as a senior energy economist in the Office of International Affairs and soon became director of the Office of Market Analysis. He has also held a variety of other senior leadership positions at DOE.

Russell Gold is the senior energy reporter for The Wall Street Journal and is based in Texas. He is responsible for covering all facets of global energy with a particular focus on the U.S. energy boom, power generation and the global energy transition. His writings appear regularly in the print and online editions of The Wall Street Journal.

Natalie Kempkey is an economist at the U.S. Energy Information Administration (EIA).

German LNG Prospects

By Henrik Vorloeper

In 2018, the German government supported the construction of at least one liquefied natural gas (LNG) regasification terminal. The construction of Germany’s first LNG terminal represents a significant shift in Berlin’s gas import strategy; so far, the country receives all its gas imports via pipeline. This article will address why Germany’s policy of moving towards LNG is so important for the global gas market and what Germany’s plans are for future LNG projects.

A major consumer enters the market

German LNG projects could create between 8 and 22+ billion cubic meters (bcm) LNG regasification capacity per year. This is not much, compared to Germany’s pipeline import capacity and the EU’s total LNG import capacity of 227 bcm/year. Germany, however, is the EU’s largest consumer and importer of natural gas and has become an important continental gas hub. The country’s commitment to LNG creates a huge opportunity for international LNG suppliers.

Most of the LNG will come from the US

The current investor relationship and off-take contracts for the German terminals confirm that US LNG producers are keen to supply Germany with LNG. The terminal operator will still participate in the global LNG market and will still be supplied by non-U.S. suppliers. Qatar, the world’s largest LNG exporter, has shown interest in ordering LNG off-take capacities at German terminals. That is especially important.

Understanding the four German LNG terminals

Four LNG terminals are planned in Germany. All terminals are different in their location, investor constellation, capacity, cost, timeframe and potential off-take contracts. Here is what we know about them and how viable their prospects are.

LNG Wilhelmshaven. The LNG terminal is a Floating Storage Regasification Unit (FSRU) located at the Jade-Weser-Port, near Wilhelmshaven. Uniper, a German energy company, Mitsui, a Japanese shipping company, and Titan LNG, a Dutch gas company, are the major shareholders. The FSRU has a capacity of 10 bcm/year and will cost $200-400 million. The terminal is planned to be operating by the end of 2022. The US company ExxonMobil and a Qatari LNG producer have already ordered substantial off-take capacities.

German LNG GmbH. This on-shore LNG terminal is located at Brunsbüttel, near Hamburg. German LNG GmbH is owned by a joint venture consisting of two Dutch companies, Gasunie and Vopak LNG, as well as the German company Marquard & Bahl. The terminal will have a capacity of 8 bcm/year and will cost $530 million. The terminal will be operational by 2022. The German energy company RWE has ordered a substantial off-take capacity and will supply LNG from the US export terminal at Corpus Christi, Texas operated by Cheniere Energy. The Swiss company Axpo is the second company that has ordered off-take capacity and will likely supply LNG from the Canadian terminal, “Goldboro”.

LNG Stade GmbH. This on-shore LNG terminal is located at Stade, near Hamburg. The main investors are the Australian investment group, Macquarie Group Ltd. and the Chinese construction company, China Harbor Engineering. The terminal will have a capacity of 4 bcm/year with upgrade potential to 8 bcm and will cost $567 million. Plans are to have it operating by 2023. There is no evidence of pre-booked capacity, but the head of the project seeks LNG supplies from the US.

Rostock LNG GmbH. The on-shore LNG terminal is located at the harbor of Rostock, on the Baltic Sea. The joint venture consists of the Russian LNG supplier Novatek and the Belgian gas infrastructure company Fluxys. The capacity of the terminal will be 300,000 cu/year, will cost $100 million and be operable by 2022. As the terminal will not have regasification capacities, LNG will be provided as shipping fuel or for truck and train transportation. Novatek will most likely be the only LNG supplier.

All four terminals are excellent prospects, but LNG Wilhelmshaven and German LNG at Brunsbüttel appear to be the most likely to be completed. Both projects also have a convenient geographical location and a stable ownership. While the German government supports construction of an LNG terminal with financial incentives, it has not ruled out financial support for another terminal.

Henrik Vorloeper is a co-founder and analyst at Eurasianventures.com

Petroleum Engineering Enrollment in Decline: Should Industry Worry?

By Paul Ruiz

Thousands of students will graduate from American colleges and universities this month. Amid the usual pomp and circumstance accompanying the festivities, this year’s graduates have reason to be especially enthusiastic. Earlier this month, the Labor Department’s March jobs report said monthly unemployment was just 3.8 percent of the labor force.

For the nation’s newly minted petroleum engineers, the opportunities seem boundless. Yet, strikingly, there are fewer of them entering the workforce than at any time in the last four years. According to data from Texas Tech University, this year the nation’s 22 petroleum engineering programs enrolled nearly 2,000 seniors—roughly 1,800 fewer than in 2016. In total, more than 4,500 U.S. undergraduates were pursuing petroleum engineering degrees in 2019, down 60 percent from three years ago.

Petroleum engineering enrollments track the volatility of crude oil prices by about two years, the Texas Tech data shows (freshmen who start their course of study when prices are high may not complete that course when prices fall). July 2014 prices peaked at approximately $98 per barrel; one year later, as prices started to decline, nationwide enrollment reached a 12,000-student high and remained at that level through the 2016 academic year.

“Students are even more aware of what oil prices are and how they might impact their jobs,” Dr. Lloyd Heinze, a professor of petroleum engineering at Texas Tech University, told me. “We talk about it with our students when they start their sophomore and junior years. Oil prices have rolled up and down every seven years or so; it’s part of our industry.”

This means that U.S. oil companies are only now feeling the recruiting pinch of OPEC’s price war with American shale producers. From 2014 to 2016, OPEC and its de facto leader Saudi Arabia refused to cut global production, causing oil prices to crash. Thirty years ago, petroleum engineering enrollment encountered a similarly steep decline when an oil glut caused a rapid price decline. The last time there were so few undergraduates pursuing Bachelor of Science degrees in petroleum engineering was 1986, when prices were approximately $31 per barrel ($2015).

“The one thing that’s different about petroleum engineering over other standard engineering programs is that we are dealing with a raw material. Other engineering programs build something from raw materials. The economics of our business is very different,” Dr. Heinze explains. “Any industry that uses raw materials is significantly influenced in price by governments.”

In a way, oil is no different than other commodities: prices are largely a function of supply and demand. However, unlike other commodities or primary produced products, petroleum powers more than 40 percent of all energy consumed, and 92 percent of the energy used in transportation. Supply shocks caused by events like civil conflict or natural disasters can create distortions that ripple throughout the economy.

In the short term, a shrinking pool of graduates could make it tougher for the industry to attract new talent. Petroleum engineering is already a small field in total enrollment terms—so small, in fact, that statistical analyses sometimes lump it in with the broader discipline of mechanical engineering. Still, the medium- and longer-term outlook is positive; BLS notes the total number of petroleum engineering jobs are expected to rise by more than 15 percent nationwide between 2016 and 2026.

As petroleum engineers age, the industry will need to replace a retiring cohort of Baby Boomers. To manage this employment “crew-shift,” oil majors are engaged in a wide-ranging public relations effort to improve the attractiveness of the discipline. Specifically, they want to appeal to Millennials and Generation Z through marketing and advertising that emphasizes environmental stewardship.

The effectiveness of oil’s marketing and advertising effort is not yet known, but the industry will have a better sense next September when an incoming class of freshmen join Dr. Heinze’s classroom. Whether enrollment figures jump or decline will signal either an expected uptick in registrations due to the oil price recovery, or, potentially, a worrisome shortage of talent.

Paul Ruiz is a policy analyst at SAFE (Securing America's Future Energy). A longer version of this article appeared in The Fuse.

Renewables Generated At Least 10% of Power in Over Half the States in 2018

By Ben Doggett

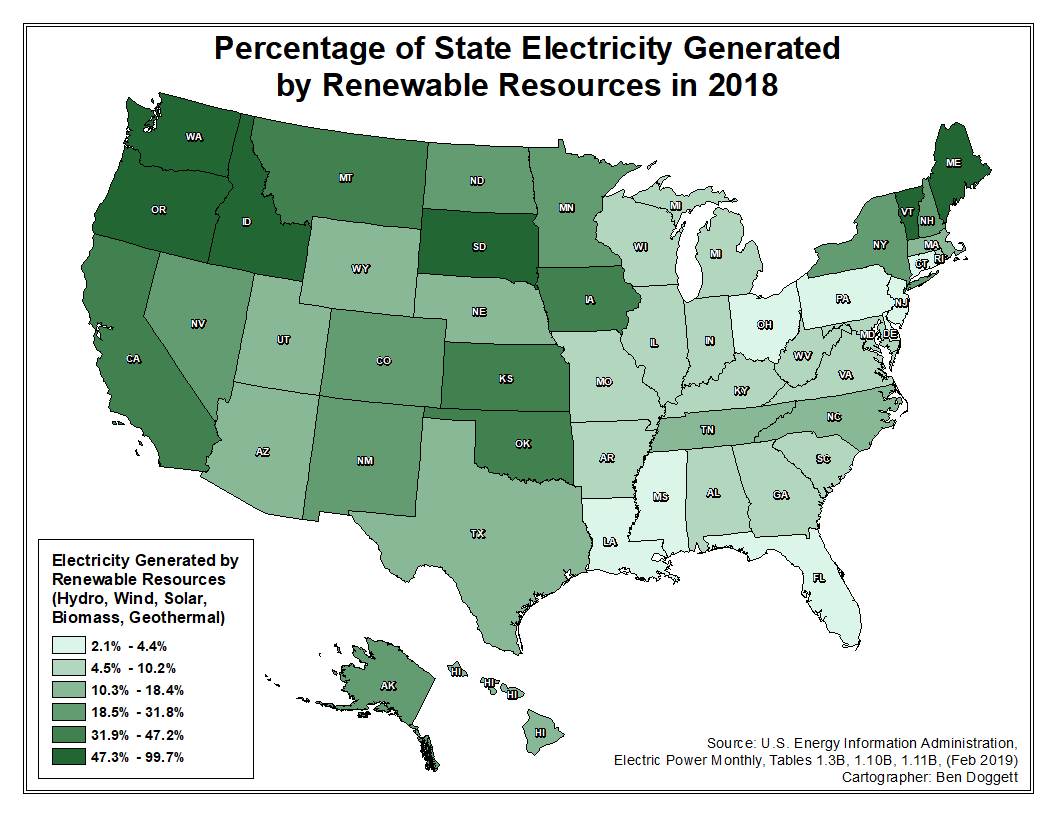

More than half of the United States generated more than 10% of their electricity from renewable energy sources during 2018, with 2 out of 5 states generating 20% or more of their electricity from renewables, according to the U.S. Energy Information Administration (EIA).

The United States generated a record 17% of its electricity from renewables—hydro, wind, solar, biomass, and geothermal—in 2018, but many states had a larger share than 17% coming from renewables.

EIA’s Electric Power Monthly shows the top ten states for renewable electricity are located west of the Mississippi River and in New England. Those states and their percentage of renewable power are Vermont (99.7%), Idaho (81.5%), Washington (77.7%), Maine (74.7%), Oregon (70.5%), South Dakota (70.1%), Montana (47.3%), California (42.7%), Kansas (36.6%), and Iowa (35.7%).

Southern states had some of the biggest growth in renewable electricity generation during 2018, with North Carolina and Alabama’s share of total generation from renewables exceeding 10% for the first time.

EIA data shows that every state generated some of its electricity from renewables at utility-scale sites of 1 megawatt or larger in 2018.

The bottom 5 states for renewable power are Delaware (2.2%), Ohio (2.5%), Mississippi (2.8%), New Jersey (3.1%), and Connecticut (3.2%).

Ben Doggett is a student member of NCAC-USAEE and a junior at Frostburg State University, majoring in Earth Science and Geography.

The Trouble with Carbon Pricing

By Meredith Fowlie

From the Energy Institute at Haas blog, UC Berkeley

We economists have long been enamored with carbon pricing. The concept is simple and sensible. If the economic damages from greenhouse gas emissions can be reflected in market prices, powerful market forces will work for, versus against, the planet. Continue reading Meredith Fowlie is an Associate Professor of Agriculture and Resource Economics at the University of California, Berkeley.

|